Datasets

Standard Dataset

Exploring the Impact Path of Carbon Information Disclosure on Equity Financing Costs

- Citation Author(s):

- Submitted by:

- Gang Ying

- Last updated:

- Sat, 12/16/2023 - 03:44

- DOI:

- 10.21227/nbe7-zf22

- License:

64 Views

64 Views- Categories:

- Keywords:

Abstract

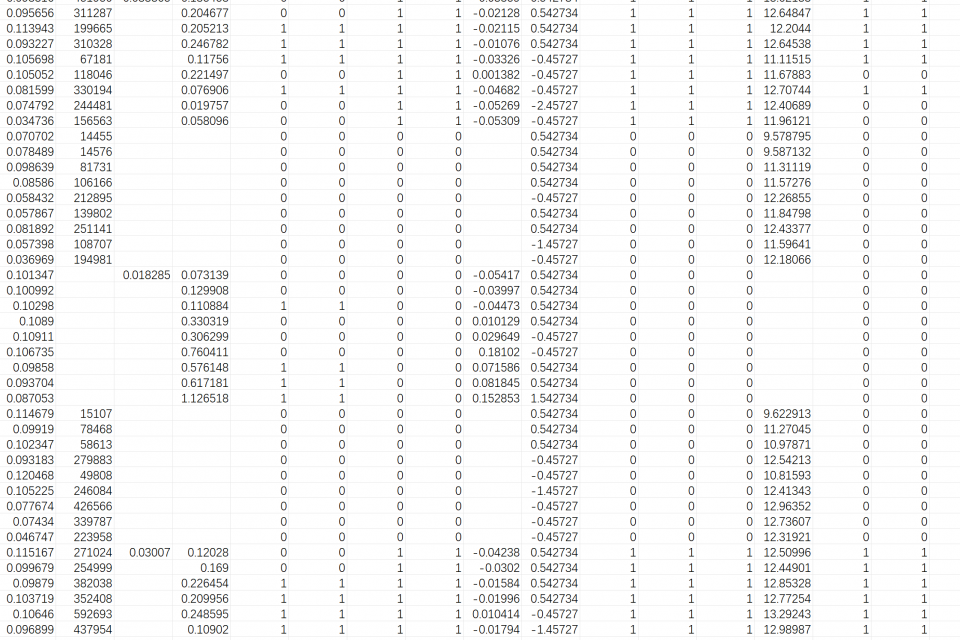

Carbon information disclosure has become a threshold for equity financing of listed companies in china. Therefore, it is of great significance to explore the relationship between carbon information disclosure and equity financing costs. This study analyzes the carbon disclosure and equity financing cost data of 1731 A-share listed companies in Shanghai and Shenzhen from 2013 to 2021, panel data models and instrumental variables are used. The results show that the improvement of carbon information disclosure quality significantly reduces the equity financing costs of enterprises. Furthermore, the study uses a combination of QCA and NCA methods to explore the impact path of carbon information disclosure on equity financing costs. The results indicate that there are three paths that can reduce equity financing costs, namely the carbon information disclosure packaging path for high-carbon-emitting enterprises, the diversified financing path for non-high-quality enterprises, and the analysts-manipulating financing path for low-carbon-emitting enterprises. This study deepens the understanding of the relationship between carbon information disclosure and equity financing, and has certain policy implications

Title: Data Usage Instructions for Carbon Information Disclosure and Equity Financing Costs

1. Introduction

Carbon information disclosure has become a crucial factor for equity financing of listed companies in China. Therefore, it is essential to investigate the relationship between carbon information disclosure and equity financing costs. This study examines the carbon disclosure and equity financing cost data of 1731 A-share listed companies in Shanghai and Shenzhen from 2013 to 2021. Panel data models and instrumental variables are employed to analyze the data.

2. Methodology

2.1 Benchmark and Robustness Tests

To ensure the reliability of the findings, benchmark tests and robustness tests were conducted using Stata. These tests validate the results obtained from the panel data models and instrumental variables.

2.2 Path Analysis using QCA and NCA Methods

In addition to the panel data models, this study employs a combination of Qualitative Comparative Analysis (QCA) and Numerical Comparative Analysis (NCA) methods to explore the impact path of carbon information disclosure on equity financing costs. QCA and NCA methods provide a comprehensive understanding of the relationships between variables.

3. Results

The results of the analysis indicate that the improvement of carbon information disclosure quality significantly reduces the equity financing costs of enterprises. Furthermore, the study identifies three paths that can reduce equity financing costs:

- The carbon information disclosure packaging path for high-carbon-emitting enterprises

- The diversified financing path for non-high-quality enterprises

- The analysts-manipulating financing path for low-carbon-emitting enterprises

4. Conclusion

This study deepens the understanding of the relationship between carbon information disclosure and equity financing costs. The findings have important policy implications for promoting sustainable financing practices.

Documentation

| Attachment | Size |

|---|---|

| 12.94 KB |