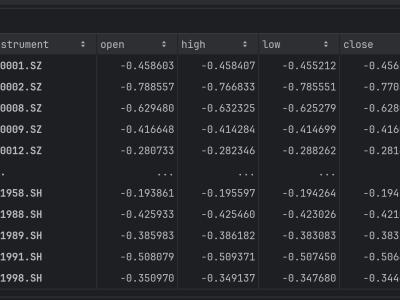

The datasets include historical daily market information in the Chinese A-share stock markets, such as closing prices, opening prices, highest prices, lowest prices, trading volumes in terms of value, and trading volumes in terms of quantity, from 2015 to 2021.

- Categories: